Have you asked yourself what will happen to the health insurance of your spouse or parents who, until now, were co-insured under your name based on your salary income?

Starting August 1, 2025, the law changes radically, and from September 1, they will lose their insured status. You will play an important role if you want them to remain insured under the public health system.

Find out what options you have for correctly filling out the Single Tax Declaration regarding income tax and the social contributions owed by individuals!

What do you need to do to ensure someone is covered by public health insurance through the 2025 Single Tax Declaration?

-

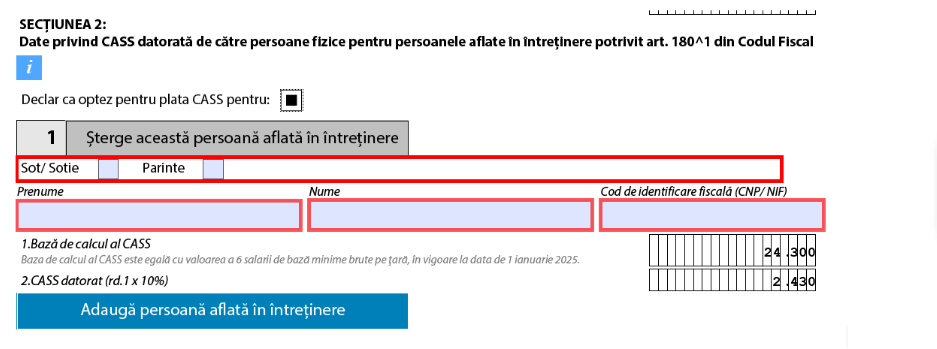

Complete the 2025 Single Tax Declaration (Declaratia Unica), specifically Chapter II, Section 2. The updated form can be found at the following link:

https://static.anaf.ro/static/10/Anaf/Declaratii_R/AplicatiiDec/dclUnica_2025-v1.0.4_01082025.pdf -

Submit the completed form to ANAF (the Romanian Tax Authority).

-

Pay the health insurance contribution (CASS) according to the deadlines set by law.

What happens if you don’t submit the 2025 Single Tax Declaration?

If you don’t complete the process, starting from September 1st, 2025, your spouse or parent will lose their insured status in the public healthcare system. This means:

-

They will no longer have access to the standard healthcare services covered by the national insurance package.

-

They will only be entitled to a minimal package, which includes emergency care and possibly a few basic consultations.

DOES FILLING OUT THE 2025 SINGLE TAX Declaration SEEM COMPLICATED? YOU’RE NOT ALONE!

Completing the Single Tax Declaration can be a challenging process—especially if you’re doing it on behalf of someone else. You may find yourself asking:

-

Which sections do I need to complete?

-

What happens if I make a mistake?

-

Do I also need to fill out Section 3 – Summary of Health Insurance Contributions (CASS)?

-

Where exactly should I submit the form?

BIA HUMAN CAPITAL SOLUTIONS IS HERE TO HELP!

At BIA Human Capital Solutions, we provide full consultancy and support for submitting the Single Tax Declaration for optional health insurance coverage for:

-

Your spouse

-

Parents without income

📌 We handle everything for you:

-

We accurately complete the form

-

We provide clear guidance on payment obligations and the bank account where the payment should be made

💼 All you need to do is contact us — we’ll take care of the Single Tax Declaration for your dependents. Help protect your loved ones!

READ Also: